- The Polish Deal is a historic tax cut and a historic increase in the tax-free amount. This fits in with the ambitious policy that Law and Justice has been pursuing for over 5 years.

- We're taking a big step forward - getting the tax system back to the right proportions. It's time to end the idea that lower earners pay higher taxes than higher earners.

- We want to create a modern and fair tax system on a European level.

- Polish Order is same rules We want to make taxes payable for all, regardless of the form of employment. We want the Poles to have a better life, we want to make it more profitable to work full-time, so that no one is forced to set up one-man businesses or work under junk contracts.

- The changes will benefit millions of Poles - workers, entrepreneurs, pensioners and many middle class professional groups. The Polish Tax Order is also a great support for Polish families. Real benefits for broad sectors of society are the hallmark of the United Right's rule.

- Polish Order is up to PLN 14 billion a year more money in Poles' wallets. For 90 percent. people who pay taxes in Poland, the new solutions are beneficial or neutral.

- Gains almost 18 million our citizens. Almost 9 million Poles will stop paying PIT. PIT will not be paid the lowest earners and nearly 70 percent of retirees. The 32 percent tax will be paid by half as many people than before.

- Polish Order is also solutions to grow businesses and get rich.

WHAT DO WE OFFER?

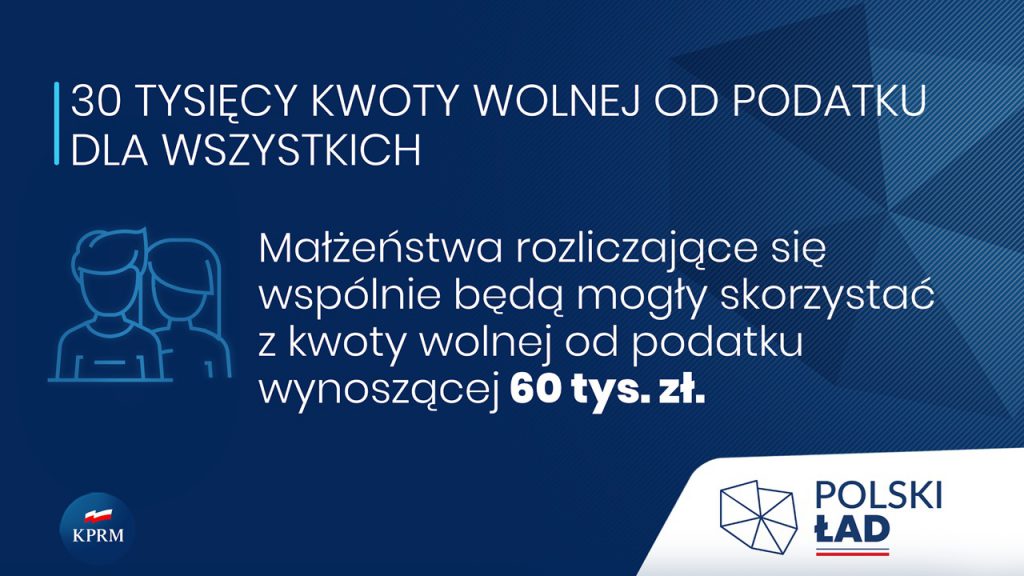

- A historic increase in the tax-free amount up to PLN 30 thousand - we're moving up to the European level.

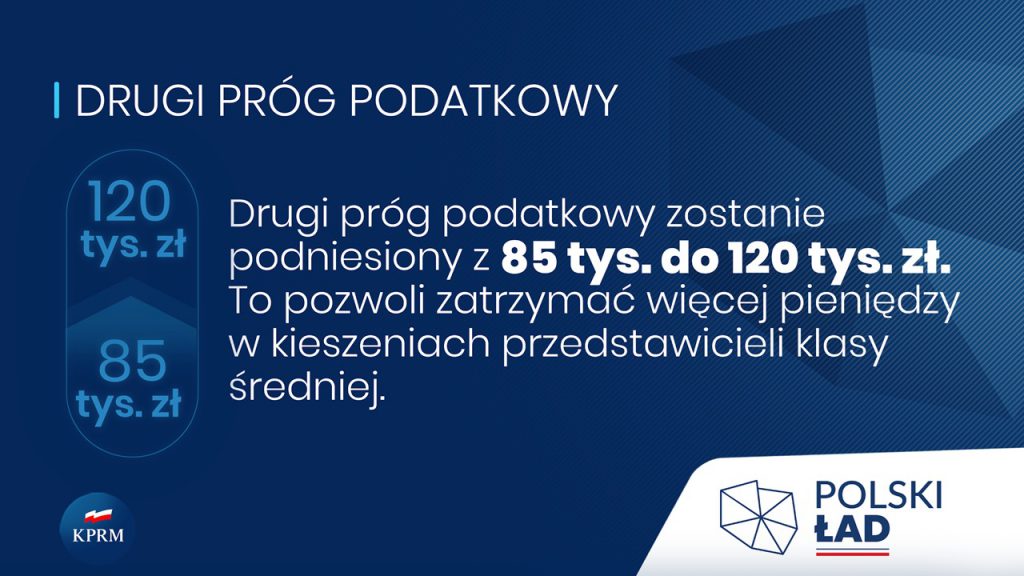

- Higher 2nd tax threshold - from PLN 85 thousand to PLN 120 thousand.

- Tax-free pension up to PLN 2.5 thousand. Pensioners with higher benefits will pay tax only on the amount exceeding PLN 2.5 thousand.

- Another reduction in flat rates for engineers, IT professions, doctors, among others.

- A health contribution on the same basis for employees and entrepreneurs - the so-called "health insurance". tax Fair Play.

HOW AND HOW MUCH WILL POLAND GAIN FROM OUR TAX CHANGES?

- Polish Order is anymore money in the wallets of Poles. For more than 23 million people, the tax changes will be beneficial or neutral. That's 90 percent of taxpayers.

- The system is structured in such a way that people employed on a contract of employment do not lose even if they earn 10-12.5 thousand zlotys. This is guaranteed by the middle class relief provided for in the Polish Lada.

EMPLOYEES, BUSINESS PERSONS AND POLISH FAMILIES

- Polish Order means more money in the wallets of workers, business people and Polish families.

EXAMPLES (full-time employees):

- Cashier earner 3 thousand PLN, will gain approx. 1840 PLN per year.

- Manual worker earner 4 thousand PLN, will gain approx. 1360 PLN per year.

- Accountant earning in the company 5 thousand PLN, gain about 560 PLN in a year.

EXAMPLES (business people):

- Tailor with income 3k, will save about 1.3k per year.

- Hairdresser with income 4k, will save about 2k per year.

- Mechanic with income PLN 5 thousand, it will save about PLN 1 thousand per year.

- Cohabiting couples will be able to take advantage of the tax-free amount amounting to PLN 60 thousand.

- A 2+2 family, in which the parents earn a total of PLN 6.5 thousand gross, when settling their accounts jointly, per month they will gain PLN 328, or almost PLN 4 thousand a year. A married couple will also be able to take a tax deduction for two children, or 2,200 PLN.

- Mr. Janusz is a letter carrier and earns 3,000 PLN per month. His wife, Elżbieta, works at the cash register in a discount shop, where she earns 3.5 thousand PLN a month. Both will benefit from the Polish Order reform. In the case of Mr. Janusz it will be 153 PLN per month. For Elżbieta the profit will be 147 PLN per month. Annually for both spouses this gives a profit of 3.6 thousand PLN.

PENSIONERS

- More money will remain in the pockets of 90 percent of pensioners and disability benefit recipients, i.e. over 8 million people. As many as 2/3 of them will not pay PIT at all.

EXAMPLES:

- Retiree retiree in the amount of PLN 3.2 thousand gain 1600 PLN per year.

- A retired couple, one receiving a minimum pension and the other receiving an average pension will gain PLN 2,997 per year.

- A retired couple in which each person receives PLN 1,800 pensionswill gain 2,946 PLN.

RECORD-BREAKING TAX-FREE AMOUNT

- We raise the tax-free amount to 30 thousand zloty - will be the same for everyone regardless of income.

- This is something that no ruling team has managed to do. It is the fulfillment of an election promise and a bold move for lower earners. It means that almost 9 million Poles will stop pay income tax.

- The level of the free amount proposed today is the finale of a long road and a process that we started 5 years ago. In 2016, the free amount for the lowest earners increased from about PLN 3.1 to PLN 6.6 thousand, and in 2018 to PLN 8 thousand. Now it will increase from 4.4 to almost 43 percent of the average annual salary.

RAISING THE SECOND TAX THRESHOLD TO PLN 120 THOUSAND

- The Polish Deal also means more people will pay a lower tax rate of 17 percent.

- Starting next year, the second tax bracket will increase by 40 percent. - From over 85 thousand PLN to 120 thousand PLN. In this way, we align the tax threshold with economic development.

- This change is part of building a strong middle class in Poland.

- As a result of our changes, the number of people in the second tax bracket will drop by half.

TAX-FREE PENSION

- We have a policy of intergenerational solidarity.

- More money will stay in pockets 90 percent of pensioners, or more than 8 million people. As many as 2/3 of them will not pay PIT at all.

- Many retirees lack the means to pay for medicine, housing, and a decent life. That has to stop. Hence the 13th and 14th pensions. But also the end of the tax on the pension to 2.5 thousand.

- Pensioners with higher benefits will pay tax only on the amount exceeding PLN 2,500.

EXAMPLES:

- A pensioner receiving a pension of PLN 3,200 will gain 1600 PLN per year.

- A retired couple, one of whom receives a minimum pension and the other receives an average pension, will gain PLN 2997 annually.

- A retired couple in which each person receives a 1.8k pension, will gain 2946 PLN.

REAL SUPPORT FOR ENTREPRENEURS - LUMP SUM

- We reduce flat rates for many professions. We are particularly concerned with strengthening the Polish middle class.

- Business owners will be able to choose the most favorable form of accounting. Taxation on general principles, lump sum or Estonian CIT.

- At the beginning of 2021, we opened the flat rate to most professions. Now we're lowering rates for more.

- For doctors, dentists, nurses, midwives, and engineers, the rate will go down

z 17 percent to 14 percent.

- For computer scientists, programmers and other ITC professions[1] rate will drop

from 15 percent to 12 percent.

- For doctors, dentists, nurses, midwives, and engineers, the rate will go down

- It will also help businesses recover from the COVID-19 pandemic.

TAX FAIR PLAY IN HEALTH PREMIUMS

- Currently, an entrepreneur has a fixed health premium and an employee has one based on income.

EXAMPLE:

An employee who has an annual salary of 100k currently pays about 7.8k health premiums, while an entrepreneur who earns the same amount pays only 4581 PLN, which is more than 40 percent less.

- There is no rational justification for this situation.

- We want to eliminate this disproportion. It cannot be that a person earning an average salary paid more than an entrepreneur earning a crore.

- From next year, both the employee and the entrepreneur will pay a health contribution in the amount of 9% of their income less social insurance premiums paid. All the money from this will go to the National Health Fund. They will be used to improve the quality of medical services and repair the health of Poles after COVID-19. Health is not to be spared!

- These funds are needed by the Polish health care system, especially during a pandemic and for a long time afterwards.

TAX FAIR PLAY TO THE STATE

- We also suggest solutions that will mobilize Poles to be fair to their own country.

- We continue efforts to reduce the underground economy, including illegal employment and income leakage to tax havens.

- This allows projects that are important to the public, such as the historic increase in the free amount, to be proposed and implemented.

- This will allow you to recover approx. PLN 6 billion in 2022 and about PLN 9 billion in subsequent years.

FISCAL REBOOT OF THE ECONOMY

- Polish Order is also a range of other solutions directed to entrepreneurs.

- So that Polish industry and Polish companies can develop and be competitive, we are creating a tax system that supports innovation, company development, foreign expansion and investment.

We will also convince Poles to return to the country with their experience, knowledge and capital.