- WE INTRODUCE THE ANTI-CRISIS SHIELD - A COMPREHENSIVE PACKAGE OF MEASURES WITH AN ESTIMATED VALUE OF PLN 212 BILLION. THIS IS ALMOST 10% OF GDP. GDP. It includes 5 pillars:

- Employee Safety,

- Corporate Finance,

- Health Care,

- Strengthening the Financial System

- Public Investment Program.

- The aim of the package is to immediately introduce solutions that will limit the negative effects of the pandemic and the recession it caused for Polish workers and enterprises.

- It also covers contract workers and sole proprietors.

- We have built a shield to defend society from the effects of crisis and epidemic and the wave of bankruptcies. .

| THE STATE OF THE POLISH ECONOMY |

- Over the past 4 years, there has been a significant decline in government debt to GDP: down 5 percentage points from 51,3 percent in 2015 to approx. 46,4 percent in 2019, the national debt is approx. 43.9 percent of GDP,

- Our dependence on foreign investors has decreased.

- The state budget in the last 3 years has been recording lowest deficit in history by sealing the tax system.

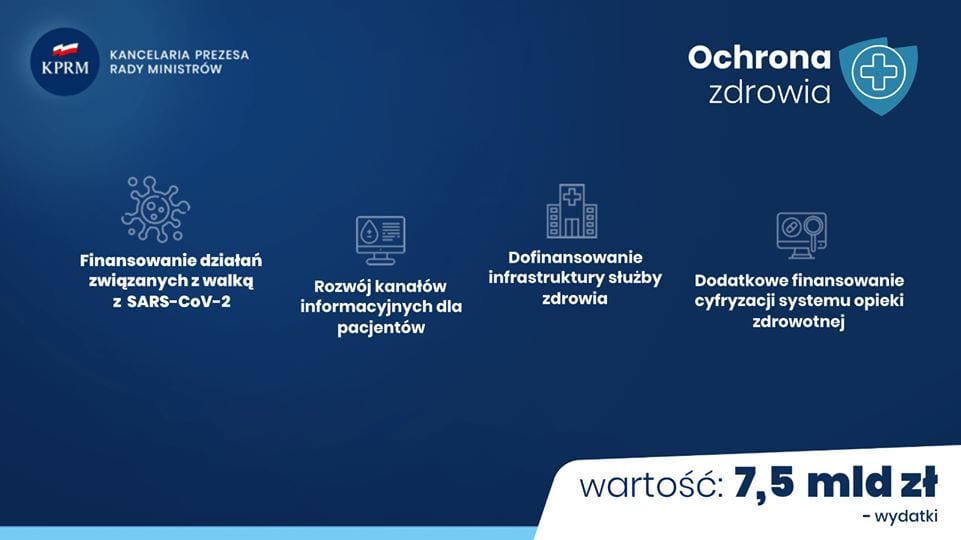

- The 2020 budget is balanced.

- Economic growth is near 3 times faster in Poland than in the euro area over the past 3 years.

- The exchange rate of the zloty is stable and The value of foreign exchange reserves is 128.4 billion USD at the end of 2019.

- Poland has high credit rating.

- Unemployment is at historically lowest level.

- In recent years the following has been carried out reform of polish development institutions The PFR Group. Their instruments are an important element of anti-crisis measures, e.g. BGK's de minimis guarantees using the created Credit Guarantee Fund.

| TOP 17 INFORMATION |

1. W Companies with problems State: Will assume funding of 40 percent of salary, the employer can reduce personnel costs by 60 percent, if it does not conduct layoffs of employees.

2. the State will cover the company in trouble nearly half the salary of a worker on parking - his/her salary cannot be lower than the minimum wage.

3. the self-employed, persons on contract of mandate and contract for specific work in the event of a decrease in their income will receive a one-time benefit of about PLN 2,000.

4 Employees may benefit in bank loan vacations.

5. Poles will benefit from the postponement of the declaration deadline PIT by the end of June.

6. the OCCP will protect against unjustified price increases

and unauthorized practices in the cash loan market.

7. small and medium-sized companies will be able to obtain extensions of working capital loans and obtain new financing secured by 80 percent guarantees de de minimis BGK.

8. companies can obtain capital in PFR and trade insurance in KUKE.

9. companies transportation companies can take advantage of IDA leasing with deferred by 3 months installments.

10. micro companies employing up to 9 people can get a low-interest loan from the Labour Fund up to PLN 5 thousand for 12 months.

11. entrepreneurs will be able to obtain a deferment or payment in instalments payments Social security payments to ZUS at no charge.

12. entrepreneurs will be able to receive a CIT refund by adjusting the 2019 tax 2019 by the amount of losses in 2020.

13. Service Healthcare will receive PLN 7.5 billion additional funds for the fight against SARS-CoV-2 epidemic, development of Patient and Physician hotlines, computerization, and development of the Medical Homes program for the elderly.

14. companies will not be be affected by delays and penalties in government procurement.

15. the Prime Minister will appoint Public Investment Fund worth PLN 30 billion: This will stimulate the economy through public investment in infrastructure, roads, hospitals, schools, digitization, energy, biotechnology.

16. there will be shift of many administrative or judicial duties and deadlines.

17. workers from Ukraine will receive an automatic extension visas and work permits.

| ANTI-CRISIS PACKAGE - A COMPENDIUM OF 5 PILLARS |

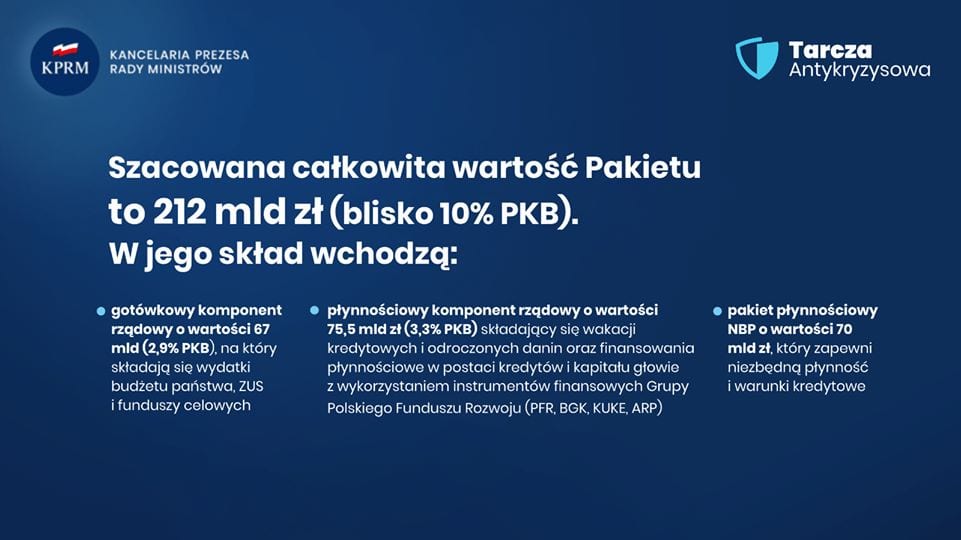

- THE ESTIMATED TOTAL VALUE OF THE PACKAGE AMOUNTS TO PLN 212 BILLION (NEARLY 10% OF GDP). IT CONSISTS OF:

- Cash component of government worth PLN 67 billion (2.9 percent of GDP): composed of expenses of the state budget, social security and special purpose funds.

- Liquidity component of the government worth PLN 75.5 billion (3.3% of GDP) It consists of credit and deferred taxes as well as liquidity financing in the form of loans and head office capital using the financial instruments of the Polish Development Fund Group (PFR, BGK, KUKE, ARP).

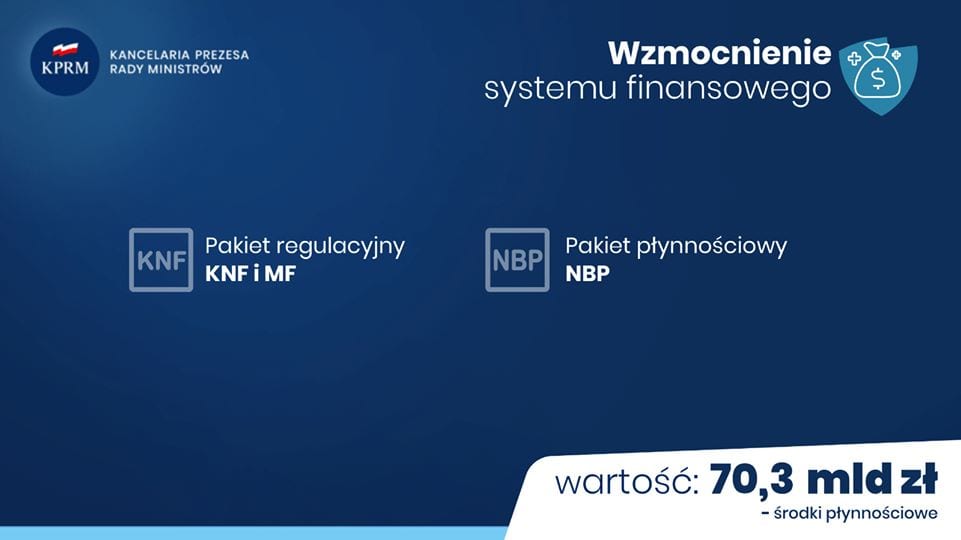

- PLN 70 billion liquidity package of the National Bank of Poland. It will provide the necessary̨ liquidity and credit terms.

| EMPLOYEE SAFETY |

- VALUE IS PLN 30 BILLION, OF WHICH PLN 23.8 BILLION IS EXPENDITURE AND PLN 6.2 BILLION IS LIQUIDITY. COVERAGE:

- subsidizing flexible employment,

- postponement of utility payments,

- Parking funding for civil contracts and the self-employed,

- Extended supplementary care allowance,

- credit vacations,

- vacation from administrative duties,

- consumer and borrower protection,

- extension of flexible working hours,

- additional support for people with disabilities.

| CORPORATE FINANCE |

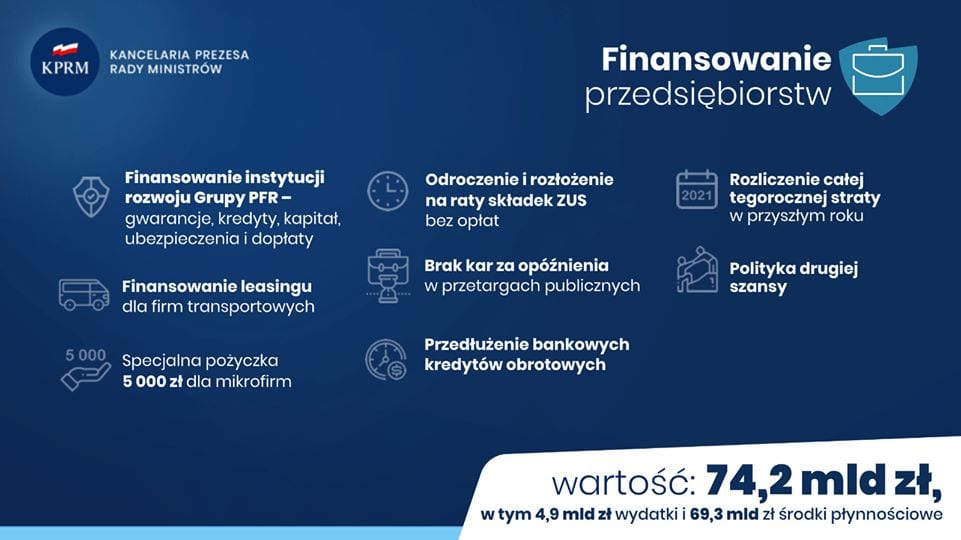

- VALUE IS PLN 74.2 BILLION, OF WHICH PLN 4.9 BILLION ARE EXPENSES AND PLN 69.3 BILLION ARE LIQUIDITY MEASURES. COVERAGE:

- financing PFR Group development institutions - guarantees, loans, capital, insurance and subsidies,

- lease financing for transport companies,